Breaking Through Domestic Competition: Mentech’s Vietnam Factory as a Roadmap for Transformer and Inductor Firms

When China's domestic market becomes saturated, growth slows, and competition intensifies, many transformer and inductor manufacturers turn their eyes overseas. Markets such as Southeast Asia offer abundant, low-cost raw materials and labor, along with access to new customer bases and revenue streams. By diversifying across multiple markets, companies can reduce dependency on a single market and mitigate operational risks.

For Mentech, building a factory in Vietnam brought both opportunities and challenges. So, what advantages does it offer? What obstacles arise? And for companies aspiring to expand abroad, how can Mentech's approach serve as a benchmark?

01 When Did Mentech Establish Its Overseas Factory?

Mentech: Mentech established its Vietnam factory in Vinh Phuc Province on December 25, 2019.

02 Motivation and Goals for Setting Up in Vietnam

Mentech: The primary goal was to actively expand our overseas market and align closely with customers'global supply chain strategies. By creating a“MENTECH VN Satellite City”model—with China as the R&D hub and Vietnam as the manufacturing base—we aimed to strengthen our presence in international markets and serve overseas clients more efficiently. To date, these objectives have largely been achieved.

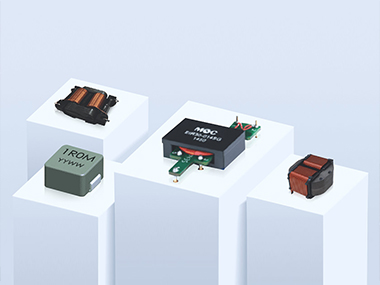

03 Product Focus and Applications

Mentech Vietnam specializes in transformers, inductors, chargers, adapters, PCBA processing, optical devices, optical modules, and OEM manufacturing for small appliances and lighting.

Main application areas include consumer electronics, telecommunications, and renewable energy.

Annual capacity includes:

Transformers & inductors: 10,000k/month

Power supplies: 1,400k/month

Optical modules: 234k/month

Optical devices: 650k/month

Annual revenue is approximately USD 50 million.

04 Local Labor and Facility Costs

Compared with China, labor costs in Vietnam are about 20% lower, averaging roughly RMB 3,000+ per month. Actual salaries depend on workdays and overtime hours, but overall labor expenses trend lower than in China.

05 Major Cost Drivers and Challenges

Mentech: Logistics accounts for the largest share of operating costs in Vietnam. Due to limited local supply resources, over 60% of materials must be sourced from China—raising both costs and quality risks.

To address this, Mentech leverages its supply chain subsidiary for centralized purchasing and strict quality inspections before shipping materials to Vietnam. For equipment procurement, we follow a rigorous process to ensure compliance with production needs and quality standards.

In the early stages, we faced language barriers and an underdeveloped local supply chain. By deploying experienced engineers and core management staff, and implementing targeted training programs, we built a highly skilled, efficient local team capable of meeting operational demands.

06 Future Plans and Key Concerns

Mentech aims to expand power electronics, electrical, and optoelectronic production in Vietnam, leveraging cost and tariff advantages to grow business in Europe, North America, and Japan.

However, uncertainties in political and global market conditions, along with the rapid rise in Vietnam's overall manufacturing costs, require proactive risk management.

07 Recommendations for Overseas Manufacturing

Based on our experience, Mentech advises:

Conduct thorough market research and site inspections to identify target markets that match your strengths.

Operate in full compliance with local laws and regulations to ensure stable long-term growth.

Set realistic sales and profit targets for overseas operations to avoid overexpansion and ensure sustainable development.

Conclusion

In today's globalized business landscape, Mentech's overseas manufacturing journey provides valuable lessons for transformer and inductor companies seeking international growth. From assessing market opportunities to building and managing operations, every step requires careful planning. While Mentech has achieved notable results, ongoing cost pressures and geopolitical uncertainties underscore the need for cautious, research-driven, and compliance-focused strategies. Only by following these principles can companies establish a solid foothold in global markets and achieve sustainable success.

Mentech Mall

Mentech Mall Group Website

Group Website